Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. Again, please note that the one cent difference in these results, $5,801.92 vs. $5,801.91, is due to rounding in the first calculation. Note that the one cent difference in these results, $5,525.64 vs. $5,525.63, is due to rounding in the first calculation.

How To Calculate The Value Of An Annuity

The present value of a series of payments or receipts will be less than the total of the same payment or receipts. This is because cash received in the future is not as valuable as cash received today. The value today of a series of equal payments or receipts to be made or received on specified future dates is called the present value of an annuity. Imagine you plan to invest a fixed amount, say $1,000, every year for the next five years at a 5 percent interest rate. The first $1,000 you invest earns interest for a longer period compared to subsequent contributions.

How to calculate the future value of an annuity due

Suppose that Black Lighting Co. purchased a new printing press for $100,000. The quarterly payments are $4,326.24 and the rate is 12% annually (or 3% per quarter). For example, assume that you purchase a house for $100,000 and make a 20% down payment. A common variation of present value problems involves calculating the annuity payment. Another way to interpret this problem is to say that, if you want to earn 8%, it makes no difference whether you keep $13,420.16 today or receive $2,000 a year for 10 years. It is important to distinguish between the future value and the present value of an annuity.

Using the TI BAII Plus Calculator to Find the Future Value for Ordinary Annuities

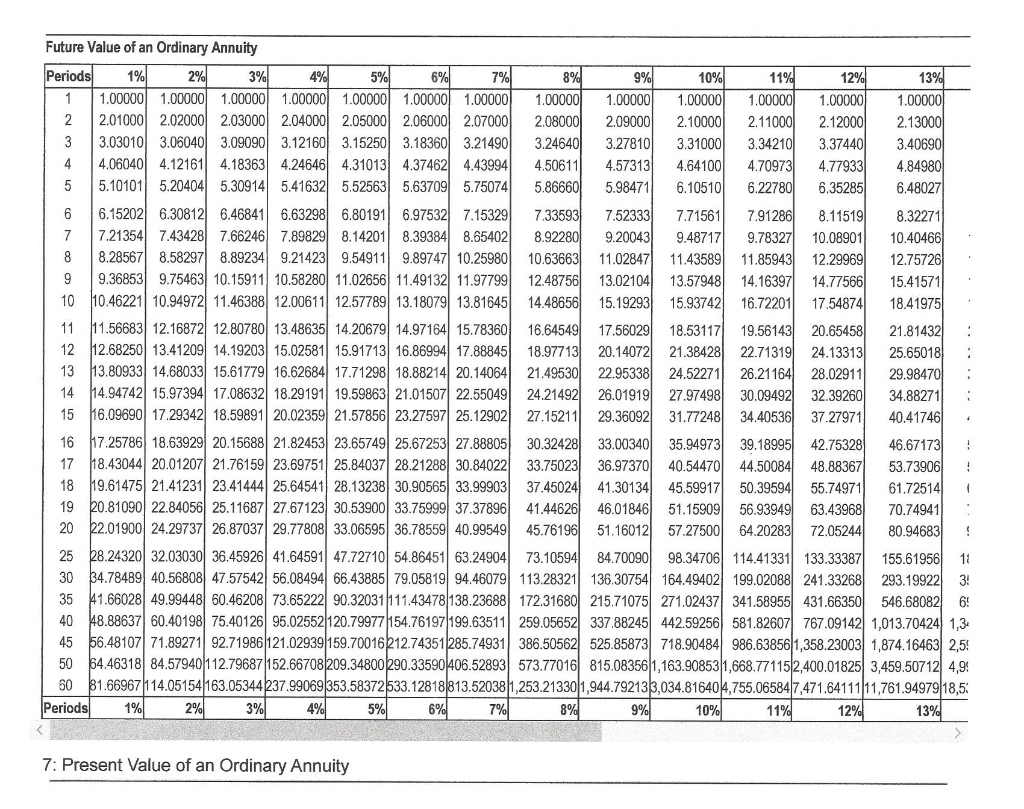

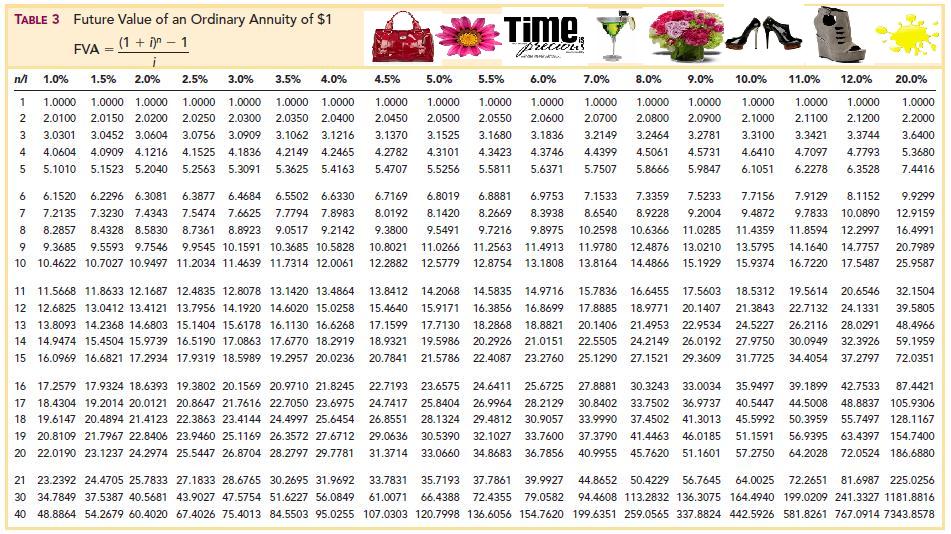

But as an investor, you might want to understand annuity tables, especially if you’re relying on guaranteed income to fund your retirement. To account for payments occurring at the beginning of each period, the ordinary annuity FV formula above requires a slight modification. Annuity tables also provide a standard that can fairly value annuities of different amounts. The IRS uses standardized annuity tables to value certain types of annuities for tax purposes. Essentially, an annuity table does the first part of the math problem for you. All you have to do is multiply your annuity payment’s value by the factor the table provides to get an idea of what your annuity is currently worth.

\boxed2.3[/latex] Future Value of Annuities Due

- Financial calculators also have the ability to calculate these for you, given the correct inputs.

- For example, assume you will make [latex]\$1,000[/latex] contributions at the end of every year for the next three years to an investment earning [latex]10\%[/latex] compounded annually.

- So, for example, if you plan to invest a certain amount each month or year, FV will tell you how much you will accumulate as of a future date.

It lets you compare the amount you would receive from an annuity’s series of payments over time to the value of what you would receive for a lump sum payment for the annuity right now. An annuity table is a tool for determining the present value of an annuity or other structured series of payments. An annuity is a financial product that provides a stream of payments to an individual over a period of time, typically in the form of regular installments. Annuities can be either immediate or deferred, depending on when the payments begin.

Present Value of Annuity Formula (PV)

This shows the investor whether the price he is paying is above or below expected value. Selling your annuity or structured settlement payments may be the solution for you. Most of these are related to the annuity contract dealing with interest rates, guaranteed payments and time to maturity. But external factors — most notably inflation — may also intuit turbotax tv commercial, ‘the year of the you’ affect the present value of an annuity. It’s also important to keep in mind that our online calculator cannot give an accurate quote if your annuity includes increasing payments or a market value adjustment based on fluctuating interest rates. Payments scheduled decades in the future are worth less today because of uncertain economic conditions.

After all of the known quantities are loaded into the calculator, press [latex]CPT[/latex] and then [latex]FV[/latex] to solve for the future value. After [latex]11[/latex] years, the client has [latex]\$66,637.03[/latex] in the account and has earned [latex]\$22,637.03[/latex] in interest. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

The future value tells you how much a series of regular investments will be worth at a specific point in the future, considering the interest earned over time. Future value, on the other hand, is a measure of how much a series of regular payments will be worth at some point in the future, given a set interest rate. If you’re making regular payments on a mortgage, for example, calculating the future value can help you determine the total cost of the loan.

It takes into account the amount of money that has been placed in the annuity and how long it’s been sitting there, so as to decide the amount of money that should be paid out to an annuity buyer or annuitant. Future value (FV) is the value of a current asset at a future date based on an assumed rate of growth. It is important to investors as they can use it to estimate how much an investment made today will be worth in the future. This would aid them in making sound investment decisions based on their anticipated needs.

Given this information, the annuity is worth $10,832 less on a time-adjusted basis, so the person would come out ahead by choosing the lump-sum payment over the annuity. The pension provider will determine the commuted value of the payment due to the beneficiary. A lower discount rate results in a higher present value, while a higher discount rate results in a lower present value. As with the future value of an annuity, the receipts or payments are made in the future.

As with the present value of an annuity, you can calculate the future value of an annuity by turning to an online calculator, formula, spreadsheet or annuity table. This formula considers the impact of both regular contributions and interest earned over time. By using this formula, you can determine the total value your series of regular investments will reach in the future, considering the power of compound interest. This seemingly minor difference in timing can impact the future value of an annuity because of the time value of money. Money received earlier allows it more time to earn interest, potentially leading to a higher future value compared to an ordinary annuity with the same payment amount. A dollar invested today not only earns a return over a specific period of time, but that return earns a return as well.